Big relief to individual taxpayers – No tax on income up to Rs 12 lakh (under new regime)

On track of fiscal consolidation – Fiscal deficit target for FY25-26 pegged at 4.4% v/s 4.8% as per RE 2024-25

Outlay for capital expenditure kept at Rs 11.2 lakh cr, ~9.8% above the RE of FY25

The Union Budget 2025-26 was largely on the expected lines with focus on broad areas covering Poor, Youth, Middle Class, Farmers, MSMEs, Export, Women and reduction of compliance burden. The budget aims to initiate transformative reforms across six domains viz Taxation, Power, Urban development, Mining, Financial, and Regulatory reforms.

Major focus of the budget was on revival of consumption leaving other expenditure heads either unchanged or with marginal revision thereby ensuring fiscal prudence. In a big boost to the Indian middle class, Finance Minister announced that there will be no income tax payable for income up to Rs 12 lakh under the new tax regime. The idea behind the move was to boost consumption, which is benign as highlighted by many consumers facing businesses over the last few quarters.

Budget outlined 10 priority areas, viz,

1) Spurring agriculture growth and productivity

2) Building rural prosperity and resilience

3) Inclusive growth

4) Boosting manufacturing and make in India

5) Supporting MSME

6) Employment led development

7) Investing in people, economy and innovation

8) Securing energy supplies

9) Promoting exports

10) Nurturing innovation

Overall, Union Budget 2025-26 appears more consumption oriented and has set the stage for next leg of inclusive.

growth of Indian economy in the backdrop of global policy uncertainties and trade wars.

Key takeaways: –

- Zero tax for salaried class up to Rs 12 lakh income: In a big boost to salaried class, government has made income up to Rs 12 lakh completely free of tax (excluding capital gains). This will drive urban consumption which has been languishing since last 2-3 quarters. This will create a positive impact on discretionary as well as non-discretionary spending.

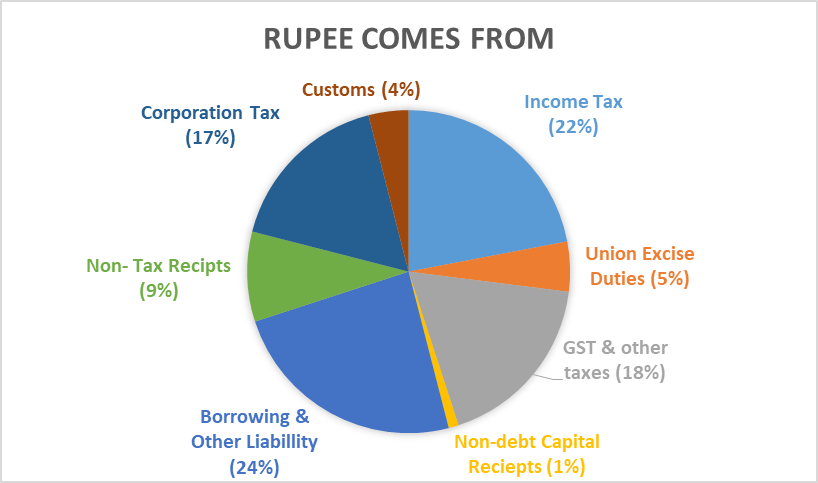

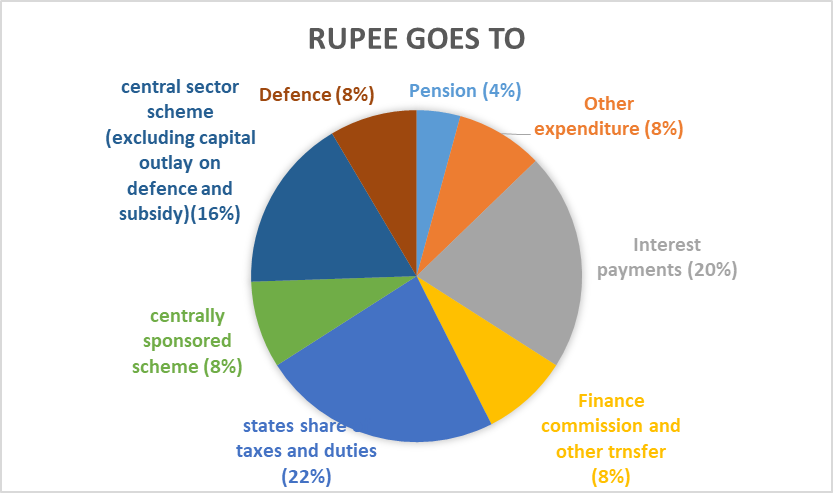

- Path to fiscal prudence is intact: The budget not only revised lower the FY25 fiscal deficit target to 4.8% of GDP v/s 4.9% BE (Budgeted Estimate) but also reduced FY26 fiscal deficit target to 4.4% of GDP. This entails total gross and net borrowing for FY26 at Rs 14.82 lakh cr and Rs 11.53 lakh cr respectively.

- Capital outlay: The government expects FY26 capex to be at Rs 11.2 lakh cr which is 10.1% higher than RE (Revised Estimate) of Rs 10.18 lakh cr for FY25 – In line with FY26E nominal GDP growth of 10.1%.

- Further boost to MSME: MSME contributes 36% of India’s manufacturing, employs 7.5 cr people and contributes 45% of India’s exports. To enable them to achieve higher efficiencies of scale, technological upgradation and better access to capital, the investment and turnover limits for classification of all MSMEs will be enhanced by 2.5x and 2.0x respectively. Steps include enhancement of a) credit availability with guaranteed cover, b) credit cards for micro enterprises, c) fund of funds for startups, d) promote labour, intensive sectors, and e) measures to boost domestic production of toys, footwear, food processing, etc.

- Fund of Funds for Startups: Fund with an allocation of Rs. 10,000 Crore will provide financial support startups, fostering innovation and entrepreneurship.

- Sectors for AI in education: 3 centres namely Agriculture, Health, Sustainable Excellence Centers in AI will be set up with an outlay of Rs 500 Crore.

- Focus on Defence, Railways and Infrastructure: The railways capex for FY26 is Rs 2.52 lakh cr similar to RE for FY25. Marginal increase in capex towards laying of new lines, signaling, track renewals, payment of capital components for leased assets, local trains in urban areas, etc. is proposed. Overall defence budget is up by ~Rs 40,000 cr to Rs 6.81 lakh cr with a capital outlay of Rs 1.8 lakh cr which is Rs 21,000 cr higher than RE for FY25. NHAI allocation for FY26 is at Rs 1.70 lakh cr v/s Rs 1.69 lakh cr as per FY25 RE.

- Nuclear Energy Mission for Viksit Bharat: Development of 100 GW of nuclear energy by 2047 is essential for energy transition efforts. Rs 20,000 cr is being allocated towards R&D of SMR (Small Modular Reactors). This will create opportunities for players specialized in building small reactors.

- FDI in insurance increase to 100% from 74%: This enhanced FDI limit will be available for those companies which invest the entire premium in India. The move is expected to bring more players into the market and drive innovation.

- Exemption of Basic Custom Duty (BCD) on raw materials, components, consumables or parts in ship breaking shall help drive growth of ship building and repair industry.

Sectoral Impact: –

| Sr.No. | Sector | Proposal In Budget | Beneficiary Companies |

| 1 | Power | 100 GW of nuclear energy by 2047. Rs 20,000 cr towards R&D in Small Modular Reactors (SMR) RLDS – To improve financial health of Discoms and power companies | NTPC, Tata Power, L&T, HCC, Power Grid, Adani Transmission, Smart meter companies (Genus Power, HPL Electric |

| 2 | Tobacco | No change In Tax structure | ITC, Godfrey Phillips and VST Industries |

| 3 | Consumption | Reduction in income tax burden | FMCG (HUL, Dabur, ITC) Hotels (Indian Hotels, Lemon Tree), Consumer Durables (Bluestar, Amber Enterprises, Havells), Auto OEMs, Jewellery players (Senco, Titan etc.) |

| 4 | Infrastructure | FY26E capex of Rs 11.2 lakh cr for sectors like Road, Highways, Railways, Defence etc. | L&T, J Kumar, NCC, Ashoka Buildcon, H.G Infra, Titagarh, Texmaco, BEL, BEML etc. |

| 5 | Agriculture | Loan limit under modified interest subvention will be enhanced from Rs 3 lakh to Rs 5 lakh through KCC Support for cotton, pulses, dairy etc. Also, 6-year mission emphasizing the production of pulses like Urad and Tur. | Farm equipment players (M&M, Escorts), FMCG stocks and Banks like PNB, Bank of Baroda |

| 6 | Leather | Focus product scheme for footwear and leather | Red tape, Metro Brands, Campus Activewear, Mirza International |

| 7 | Electronics (EMS) | Reduction in custom duties on components | Dixon Technologies, PG Electroplast, Epack Durables |

| 8 | Telecom | Broadband connectivity to government secondary school and PHCs | Tejas Network, HFCL |

| 9 | Water | Jal Jeevan mission extended till 2028 | APL Apollo Tubes, Hi-Tech Pipes, Jindal Saw, Welspun Corp |

| 10 | Airline | Modified Udaan Scheme will be launched to connect 120 new destinations and carry 4 crore passengers in next 10 years | GMR Airport, Interglobe Aviation |

| 11 | Tourism | Top 50 tourist destination will be developed | IHCL, Chalet Hotels, Lemon Tree, IRCTC, Thomas Cook, Praveg, ITC Hotels |

| 12 | Healthcare | Medical tourism and heal in India promoted in partnership with private sector | Aster DM, Apollo, Fortis, Rainbow Children |

| 13 | Battery Manufacturing & Recycling | Full exemption of custom duty in cobalt powder and waste, scrap of lithium-ion, lead, zinc, and other minerals Exemption of custom duty on capital goods for manufacturing of lithium-ion batteries | Amara Raja, Exide, Gravita India, Pondy Oxides |

Tax Reforms – Relief for Taxpayers.

Income Tax Rates – New Tax Regime 2025 V/S 2026:

| Previous | Tax (%) | Now | Tax (%) |

| Up to 3 lakhs | Nil | Rs. 0-4 lakh | Nil |

| Rs 3-7 lakh | 5% | Rs. 4-8 lakh | 5% |

| Rs. 7-10 lakh | 10% | Rs. 8-12 lakh | 10% |

| Rs. 10-12 lakh | 15% | Rs. 12-16 lakh | 15% |

| Rs. 12-15 lakh | 20% | Rs. 16-20 lakh | 20% |

| Above 15 lakhs | 30% | Rs. 20-24 lakh | 25% |

| Rs. Above 24 lakh | 30% |

Individuals earning up to Rs. 12 lakhs (Rs. 12.75 lakhs for salaried individuals before standard deduction under new scheme of Rs. 75,000) will not be required pay personal income tax. This helps with increasing income, in turn savings and investments.

Simplifying Compliance: TDS and TCS changes

- Interest earned by Senior Citizen – TDS deduction Limit increased from Rs. 50,000 to Rs. 1,00,000

- TDS deduction limit for Rent – Increased from Rs. 2,40,000 per annum to Rs. 6,00,000 annually.

- TCS Section 206C(1H) i.e., TCS on Sale of Goods to be omitted. However, TDS on Purchase u/s 194Q to remain same as before.

Government Receipt & Expenditure: –

Conclusion: –

The union budget 2025 of India focuses on green energy, AI development, MSME support, promotion of export, etc. However, there is zero tax for class up to 12 lakh income and it is a big relief to middle income level people. Sectors like automobiles, real estate, FMCG, healthcare, renewable energy, railways, defense, banks and NBFCs are well positioned for long term growth.