Corporate accounting is one of the most important parts of the finance world. Whether you’re planning to become an accountant, financial analyst, or future finance manager, understanding the basics of corporate accounting will give you a strong advantage. Today, most companies small, medium, and large need professionals who can manage finances, prepare reports, and support business decisions. This is why students who want to build a stable career in finance often begin their journey by learning corporate accounting.

In this blog, we’ll break down corporate accounting in simple terms and guide you on how to start your learning journey, especially if you are a beginner.

What Is Corporate Accounting?

Before diving deeper, let’s answer the basic question: what is corporate accounting?

Corporate accounting refers to the process of recording, preparing, and analyzing financial information within a company. It ensures accurate reporting, transparency, and compliance with financial regulations. Unlike simple bookkeeping, corporate accounting focuses on financial statements, budgeting, forecasting, and strategic planning at a corporate level.

It plays a major role in helping businesses understand their revenue, expenses, growth, and long-term financial stability. This is why corporate accounting is one of the most in-demand skills in the finance industry.

Types of Corporate Accounting

Corporate accounting includes different branches that help companies manage their finances effectively. Here is a quick overview (before diving deeper):

These types ensure smooth financial operations and provide valuable insights for decision-making.

1. Financial Accounting

Focuses on preparing financial statements such as the Balance Sheet, Profit & Loss Statement, and Cash Flow Statement.

2. Managerial Accounting

Involves budgeting, forecasting, cost analysis, and internal financial planning to support management decisions.

3. Tax Accounting

Deals with tax planning, GST, TDS, income tax, and ensuring a company follows tax laws accurately.

Key Functions of Corporate Accounting

Corporate accounting performs several responsibilities that help companies operate efficiently. Before exploring the details, here is a short explanation:

It ensures the timely preparation of reports, manages funds, and supports financial planning through accurate data.

1. Preparing Financial Statements

Corporate accountants create the P&L, Balance Sheet, and Cash Flow Statement, which help the management evaluate financial performance.

2. Cash Flow Management

Tracking cash inflow and outflow ensures companies have enough working capital to run daily operations smoothly.

3. Budgeting & Forecasting

These functions help organizations predict future expenses, allocate budgets, and plan long-term strategies.

4. Compliance & Internal Controls

Corporate accountants ensure the company follows accounting standards, tax laws, and maintains financial transparency.

5. Cost & Revenue Tracking

This helps identify profitable areas and reduce unnecessary expenses to improve overall efficiency.

Essential Skills Needed in Corporate Accounting

To build a strong career in the corporate finance field, students must develop certain skills. Before we explore them, here’s a quick note:

These skills help beginners become job-ready and increase their chances of corporate success.

1. Analytical Thinking

Accountants must analyze financial reports and understand trends that influence decision-making.

2. Financial Reporting Skills

Creating accurate financial statements is one of the key responsibilities in corporate accounting.

3. Basic Taxation Knowledge

Understanding GST, TDS, and income tax helps students become more effective in corporate roles.

4. Software Skills

Strong command over Tally, Excel, SAP, and ERP tools is essential. This is one of the most important accounting skills for students today.

5. Attention to Detail

Even small mistakes can lead to incorrect reporting, so accuracy is crucial.

Career Opportunities in Corporate Accounting

Corporate accounting opens the door to diverse and stable career paths. Here’s a quick overview before we list them:

From financial reporting to compliance, students can choose roles based on their interest and skill levels.

1. Corporate Accountant

Handles financial reports, budgeting, and internal accounting processes.

2. Accounts Executive

Manages daily entries, reconciliations, and basic finance operations.

3. Financial Analyst

Analyzes data to support business decisions and long-term planning.

4. Taxation Executive

Works on tax returns, compliance, and tax-related documentation.

5. Internal Auditor

Examines company processes to ensure accuracy and compliance.

Thanks to growing corporate structures, these roles are in high demand across industries.

How Students Can Start Learning Corporate Accounting

If you want to build a career in finance, the right learning path is important. Before getting into the steps, here’s something to note:

Students must combine theory with practical knowledge to succeed in the corporate world.

1. Join a practical corporate accounting course

Choose a course that focuses on real accounts, not just theory.

2. Learn essential accounting software

Tools like Tally, SAP, and Excel are used in almost every company.

3. Study real case studies

Understanding how companies maintain accounts gives clarity on real-world finance.

4. Choose the right training institute

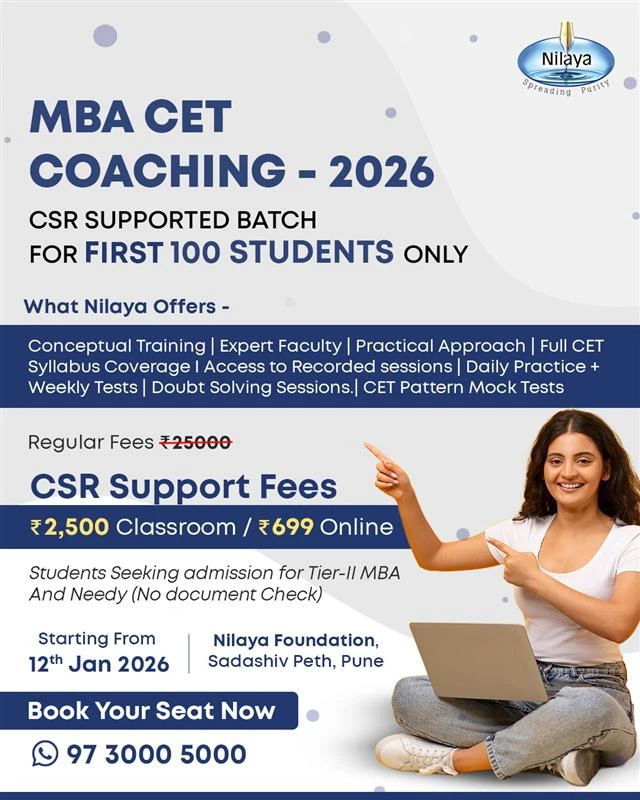

This is where Nilaya Education corporate accounting course(CAM) plays a major role.

Nilaya offers corporate-level accounting training with practical modules, real company accounts, and job-oriented learning. For anyone who wants to learn accounting in Pune, Nilaya Education is one of the most preferred options due to its advanced corporate-style curriculum and strong placement support.

Conclusion

Corporate accounting is an essential part of every successful business. It helps companies maintain financial accuracy, plan growth, manage resources, and stay compliant with regulations. For aspiring finance professionals, learning corporate accounting is the first step towards building a strong and secure career.